As what was voluntary becomes mandatory, smarter companies are weighing the reputational cost/benefit of persisting with dodgy, inaccurate and partial emissions policies

Money/Carbon Thought Experiment

If you’re still uncertain how to spot greenwash, imagine landing on Company A’s website to find:

- Front and centre, a passionate statement on the importance of making money

- Company A’s unswerving promise to deliver an unspecified amount of profit or shareholder value at an unspecified future date

- An official-looking endorsement from a paid third-party stating that Company A is sincere in it’s determination to make money, but lacking key specifics, such as the unit of currency, or transparency

Substitute ‘reducing carbon’ for ‘making money’, and this accurately describes most corporate websites. Yet more evidence, as if more evidence were required, that we take money a lot more seriously than we take carbon reduction.

Whether such corporate claims of ‘carbon neutrality’ are cynically disingenuous, or naively ignorant, is beside the point.

When it comes to measurable, enforceable emissions reduction, motivation really doesn’t matter. CO2 is CO2. It has no ‘brownie point’, ‘good guy’ or ‘bad guy’ isotopes.

Greenwash all the way

This, broadly speaking, has been the state of play for emissions reporting and accounting for the past few decades. Getting away with it. Ducking and diving to justify business as usual.

This era of wilful ignorance has lasted damagingly long, but is on its last legs. As the urgency for climate action becomes more apparent to more people, the room for manoeuvre for obfuscation, distraction, denial and delay has narrowed.

There has been some kind of ‘progress’ – we’re about to describe its trajectory – but if this cautionary tale of greenwash and greenhouse gas emissions reporting history holds any lesson, it’s the importance of maintaining a laser-like focus on accurate, measurable reduction in metric tonnes of a finite physical resource – the proportion of our planet’s closed-loop carbon that’s in the ground, and in the air. Burning fossil fuels transfers more of it from underground to the atmosphere, and we’re still not stopping.

The last thirty years have shown us how we’ve lost that focus. These reach an annual peak at COP meetings, where they’re all on regular display:

- political horse-trading

- using money as a proxy for carbon reduction

- special pleading

- outright denial and sabotage from vested interests

Permit these to come between the simple goal of emissions reduction, measured in tonnes of CO2e, and executing it, and we already know the result – rising emissions. The ‘greenwash gap’ is the space we’ve allowed to grow between fine words, and inaction.

Our failure to reverse carbon emissions over the last decades has taught us another important lesson – the tools that are effective when it comes to real-world. accurate, measurable emissions reduction:

- make it compulsory

- count all emissions

- cut out loopholes

- transparent verfication

- transparent, consistent enforcement

It may be frustratingly, unnecessarily and dangerously late, but finally, things are changing, and changing fast.

A tale of two curves

Let’s address the ‘but but but…’s that come from those defending Carbon Accounting 1.0:’s efforts so far to self-regulate.

They all crumble in the face of one very big inconvenient truth.

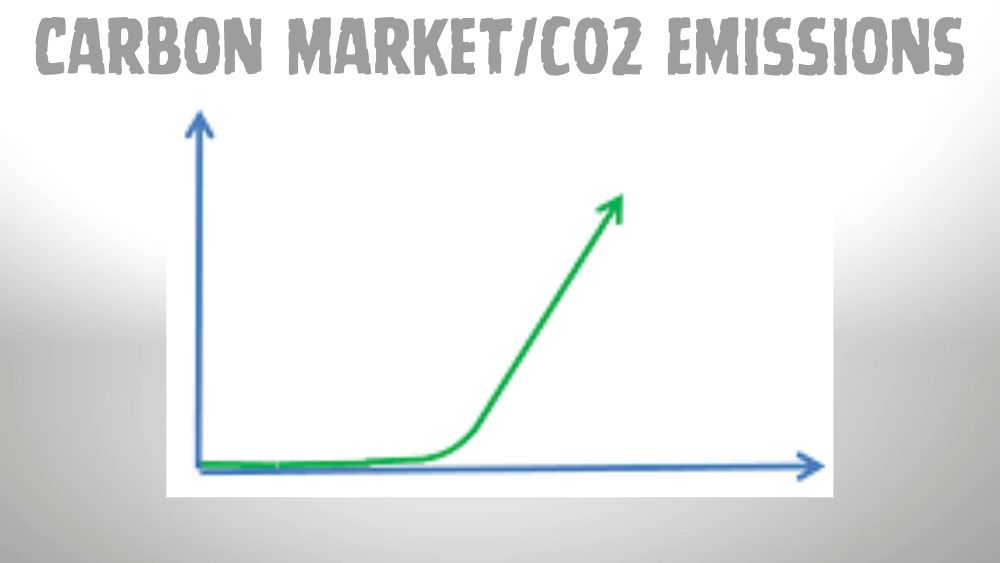

Take a look at the hockey-stick curve graphic at the top of this article. You can guess the x-axis unit is Time (about the last three decades, as it happens). But what about the Y-axis?

- Is it the value of the carbon reporting/trading/credit/accounting industry over the past 30-odd years, measured in US$?

Could be – the first carbon credit was issued in 1988, and the total market value of the carbon industry is set to pass US$1Tn in 2024.

- Or is it the increase in greenhouse gas emissions over the same period, measured in parts per million equivalent of CO2 molecules, measured from observatories on the top of big mountains around the world?

Also yes. Could be, if you anchor the starting point at 30 years ago, and not zero. CO2 ppm in 1988 was 351. Today it’s 422 and still rising.

It’s possible to argue that we started from a very low base in 1988, and that progress has been made, but the bleak reality of the dual-function hockey stick curve makes it impossible to claim that, overall, what we’ve been doing has ‘worked’.

We’ve written at length about how to spot greenwash, and right questions to ask of activists, as well as corporations.

But what’s the point of creating, and persisting with, a trillion-dollar industry, if it’s failed so utterly to demonstrate any impact on it’s original purpose, carbon reduction?

The problem with voluntary

Voluntary agreements have long been negotiated by vested interests who profit from a fossil-fuel based status quo, from oil-producing states to companies who just want to avoid ‘yet more red tape’ interfering with their primary function of creating shareholder value.

The thought experiment that started this article tells the story of voluntary corporate carbon reporting over the past few decades.

Governments, at annual COP events, have hoped the climate problem will either go away on its own, or not get too obviously bad on their watch. They allowed themselves to be persuaded it would be OK to place the burden of carbon reduction on ‘voluntary agreements by the companies that produce most of the emissions.

It suited their short-term political interests to allow the audit trail between their grandiose national-level promises, pledges, goals and targets, and real-world verifiable carbon reduction to be deliberately fuzzy and vague.

Create loopholes, and guess what – companies exploit them – especially when they’ve helped negotiate them at each COP event (corporate interests routinely outnumber climate activists at COP meetings).

The main way to leave things fuzzy was to allow ‘voluntary’ targets, and let companies set their own terms and rules for measuring, enforcing and accounting for their emissions.

Double Jeopardy of Inaction

Now that emissions reporting is, finally, moving from the realm of Voluntary (effectively, a branch of PR) to the realm of Mandatory (in practice, a new compliance requirement), corporations are suddenly getting very concerned indeed about their carbon reporting.

The obvious reason is that they now have no choice. Governments, lead by the EU, but also by increasingly stringent requirements in Asia, especially India, China and Japan, are now mandating demonstrable, verifiable, real-world carbon reductions.

Corporations are being rudely awoken from their complacency. Forward-thinking businesses are realising the previous blocking tactics of fine, cheap words and ‘carbon neutral’ badges bought via the discredited system of papal-indulgence-style ‘offsetting credits’, are rapidly becoming doubly risky:

- From a practical perspective, governments and public opinion will no longer ‘buy’ this kind of opaque, commercial carbon accounting

- From a reputation management perspective, persisting in, or even doubling down, on these kind of performative ‘actions’ risks making them look out of touch, insincere, or stupid, to their investors, shareholders, employees, customers, children and grandchildren

Know Your Scopes

At the first COP meeting in Berlin in 1995, governments made the roughest of calculations of their respective carbon emissions contributions, based on back-of-the-envelope, unsophisticated factors like oil imports and energy production.

Ever since, carbon reporting has moved on an inexorable, if slow, trend away from rough estimates, and towards accurate carbon footprint measurements that reflect reality.

As the climate crisis has intensified, pressure for more accurate reporting has grown from the top, and percolated its way down.

Reporting requirements are now more detailed, granular and specific. Each COP iterates another effort by oil-producing states to keep loopholes open, and pitifully slow though this process is, the trend is towards broader, tighter regulation.

This is seen both in increasingly specific regulations, and in extending those regulations requiring accurate reporting further down the supply chain.

At first, countries got away with calculating Scope 1 (direct emissions) only. Once it became untenable to claim this number represented their entire carbon footprint, it was expanded to Scope 2 (indirect emissions from utilities used).

Evidence suggests everything else (i.e. Scope 3) could account for up to 90% of any entity’s carbon footprint – Scope 3 has been called the ‘dark matter’ of carbon reporting.

Now carbon reporting is moving from voluntary schemes towards regulated comprehensive reporting, businesses are scrambling to work out how to comply with increasingly stringent Scope 3 reporting.

The Intractable Problem

Barely a week goes by without a webinar, conference, or workshop focused on ‘Business’s Scope 3 reporting problem’.

The problem is, the tools that have proved useful in the Voluntary era are proving ineffective now reporting has become mandatory.

Specifically, Scope 3 reporting, in one form or other, required accurate, consistent and verifiable reporting of the emissions from the long supply chains. The Small and Medium-Sized Enterprises (SMEs) that make up these supply chains may account for 70% of total business emissions.

Here’s the problem – they will never realistically be able to afford the kind of expensive commercial carbon reporting, auditing and consultancy services offered by Carbon Accounting 1.0.

AI, the current go-to white knight, is little help, because the data it need to train on is so inaccurate, and imprecise.

Intractable problems require fresh thinking, and fundamentally different approaches.

A tractable solution

The principle behind See Through Carbon‘s accurate, free, open source and transparent model is simple, and goes back to the laser-like lesson we’ve learned from our efforts to date.

See Through Carbon measures success or failure in the same physical unit used by climate scientists – tonnes of CO2e reduced or sequestered.

Rather than create its own bespoke carbon auditing standards, like Carbon Accounting 1.0’s commercial alternatives, See Through Carbon acts as an aggregator of the current best available open source and free licence conversion factors, reflecting the latest science. This transparency removes one of this big problems of commercial standards – for whom protecting their IP in a black box is good for business, but hopeless for transparent audit trails.

Being open source will also mean See Through Carbon will be flexible, able to adapt to the latest and best science as it becomes available, rather than remaining in opaque statis, until the standard’s next closed-door expert panel review meeting.

Carbon auditing will never be as comprehensive as financial auditing, because carbon-based life on Earth is way more complex and sophisticated than the promise we invented 5,000 years ago called ‘money’.

But complexity is no excuse for inaction. Better to see it as a spur to attain similar levels of sophistication as financial auditing, even though the objective is fundamentally different.

The first step must surely be to abandon our ingenious, elaborate, expensive, but failed, attempt to use money as a proxy for carbon reduction, and just measure the CO2, without fear or favour.

It’s the carbon, stupid.